Nse: Dmart

DMart is a leading Indian retail corporation that operates a chain of hypermarkets across India. The company provides many products, including groceries, clothing, beauty products, health and furniture, and more.

DMart remain founded in 2002 by Radhakishan Damani. Nse: DMart has its headquarters in Mumbai. DMart, also known as Avenue Supermarts Limited. DMart has over 300 stores in India and more than 68,000 employees.

The company launched its original public offering (IPO) in March 2017 and remained listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). On February 10, 2020, the closing price of DMart’s outstanding equity shares on the NSE and BSE was ₹2,483.65 and ₹2,484.15 per equity share, respectively.

Table of Contents

How much did Nse: Dmart Share Price Performed This Year?

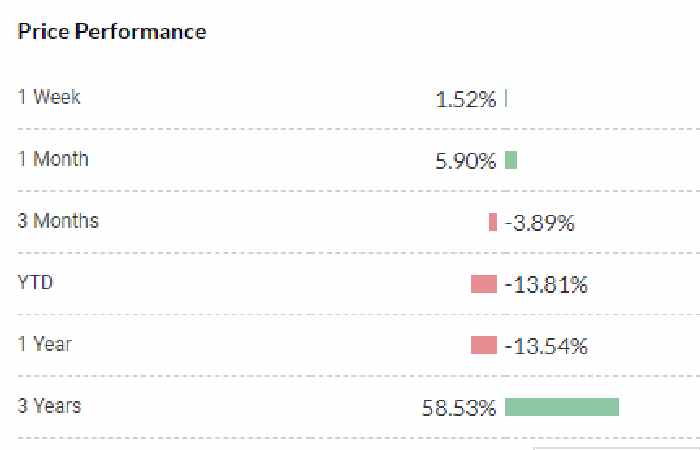

The performance of DMart’s share price has been a mixed bag in recent times. Year-to-date, DMart’s share price has decreased by 14.05%, a significant drop for the company. However, this share price decline needs to remain viewed in the context of broader market trends and the impact of the ongoing COVID-19 pandemic on the retail sector.

Despite the decline in share price this year, DMart has had a significant return of 58.09% over the past three years. It indicates that the company has been growing at a healthy pace, and investors who have held onto their shares over the long term have seen good returns on their investments.

Currently, DMart’s share price is stable with low volatility and is trading on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Despite the challenges posed by the pandemic, DMart has managed to maintain its position as one of the leading retail corporations in India and is well-positioned to last its growth trajectory in the years to come.

History of Avenue Supermart Limited or Nse: Dmart

The company remain initially incorporated as Avenue Supermarts Private Limited in Mumbai on May 12, 2000. DMart provides a wide range of products, including groceries, home appliances, clothing, footwear, and more, and it has over 300 stores in India. The company’s robust e-commerce platform allows customers to shop online and get their products delivered to their doorstep.

DMart remained founded by Radhakishan Damani, who remained already established as one of the more successful and well-known value investors in the late 1990s. The company launched its IPO in March 2017 and remained listed on the NSE and BSE.

DMart has subsidiaries and a strong presence in India’s retail industry, focusing on providing quality products at competitive prices to its customers. The company’s financial results, shareholding, and annual reports are available on its website. With its innovative business model and strategic approach, DMart has become one of India’s most successful retail chains.

How To Buy Nse: DMart Share?

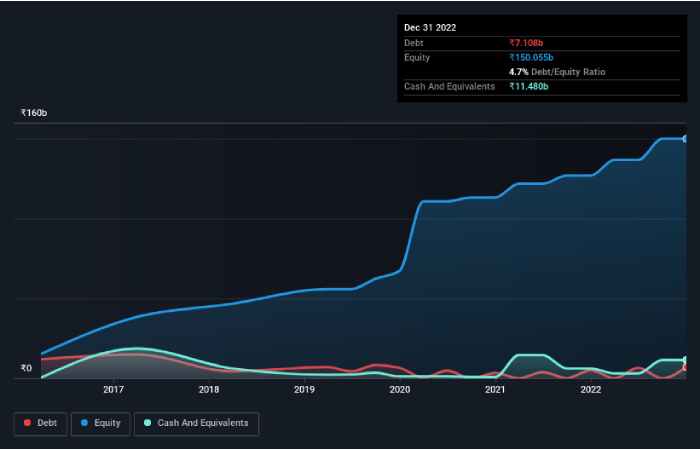

If you want to buy DMart shares, you can create a Demat account and get the KYC documents verified online at Groww. The company has a market capitalization of ₹2,26,704Cr and a debt-to-equity ratio of 0.05.

Despite a 14.05% decrease in its share price year-to-date, DMart has had a significant return of 58.09% over the past three years. In December 2022, four top domestic mutual funds had invested in the company. Brokerage firm Prabhudas Lilladher has given a ‘buy’ rating to DMart, despite the stock’s 27% correction from its 52-week high.

The brokerage also expects huge growth potential, given the low competition in modern trade and fast scale-up in DMart Ready. DMart remain well-positioned to continue its growth trajectory despite the challenges posed by the pandemic and maintain its position as one of the leading retail corporations in India.

Avenue Supermart Share Analysis

DMart has had a significant return of 58.09% over the past three years. From a technical analysis standpoint, the stock is currently in a neutral position with a score of 47.57. However, the indicators suggest that the stock is trending upward and will likely continue its growth trajectory.

The moving averages and technical indicators suggest a buy, while there are no indications to sell. To buy DMart shares, investors can consult with top domestic mutual funds or brokerage firms like Prabhudas Lilladher, which has given a ‘buy’ rating to DMart.

With its strong market position and growth potential, DMart remain well-positioned to continue its growth trajectory and maintain its position as one of the leading retail corporations in India. Investors may consider DMart shares as a good purchase for their portfolio.

Who is the CEO of Avenue Supermarts Limited (Nse: Dmart)?

The current CEO and Managing Director of Avenue Supermarts Limited, known as DMart, is Ignatius Navil Noronha. He is a prominent figure in the retail industry and has led the company since its inception.

Mr. Noronha has been instrumental in DMart’s success, which has maintained its position as one of the leading retail corporations in India despite the challenges posed by the pandemic. As of 2023, Mr. Noronha holds company shares worth over a billion dollars.

Another notable executive at DMart is Akash Lonare, the Chief Executive Officer. Investors looking to buy DMart shares can consult with top domestic mutual funds or brokerage firms like Prabhudas Lilladher.

What is the Share Price of Nse: Dmart?

As of April 18, 2023, the share price of Avenue Supermarts is Rs. 3,477.40 on the National Stock Exchange (NSE) in India. However, it remains essential to note that the share price is subject to change depending on market conditions and other factors.

Avenue Supermarts is the company that owns and operates DMart stores, a supermarket chain that offers a wide range of products. Despite declining share price this year, DMart has had a significant return of 58.09% over the past three years.

The firm has a marketplace cap of Rs. 2,26,704 crore and operates approximately 302 stores across several states in India, including Maharashtra, Gujarat, and Karnataka, among others. Overall, Avenue Supermarts’ share price is an essential indicator of the company’s performance and growth potential in the Indian retail market.

Conclusion

DMart, owned by Avenue Supermarts Limited, has had a strong financial performance in the past few years with a 5-year change of 137.63%, a snowflake score of 16/24, and earnings of ₹23.45b. Although the company’s share price has decreased by 14.05% this year, it has had a significant return of 58.09% over the past three years.