In a nutshell, a market maker is someone who helps to provide liquidity in the financial markets. Market makers are mainly employed by exchanges. They are not able to control the prices, but they are tasked with filling orders to ensure that investors get the best possible price for their coins. The primary goal of an exchange is to provide a platform for buying and selling cryptos. It also enables users to convert the coins into fiat.

Liquidity is one of the most important factors in the performance of a market. Low liquidity can lead to sudden spikes and sharp drops in the price. Therefore, a market maker should ensure that the spread between bids and asks is low. This will create more profit margins for market makers and will help to keep the market stable.

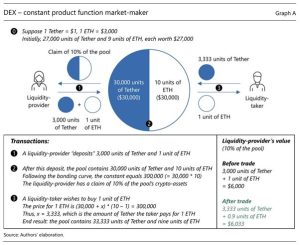

In a decentralized exchange, a market maker uses a smart contract to execute the transaction automatically. An automated market maker (AMM) provides a means for individuals to trade cryptocurrencies for a living. However, AMMs are only available on decentralized exchanges. These exchanges have a low cost and allow users to make financial transactions without having to rely on a third party.

Automated market maker crypto are a new way to access financial opportunities. These systems work by using smart contracts that run on the blockchain. When the conditions meet, the contract is triggered and executed.

There are several different kinds of market makers. Some are used to boost the liquidity of a specific asset market. Others are used to create liquidity pools.

As a market maker, you will need an impressive trading capital. You will also need to keep a tight spread. If the spread is too wide, it can make it difficult for buyers to enter and exit trades. That is why market makers actively place orders for reducing the spread. Traders will also be able to benefit from slippage opportunities.

With a market making system, you can earn passive income by doing research and taking advantage of arbitrages. You can also earn in the market by performing common trading strategies, such as buying and selling a particular asset. By doing research, you can also discover hidden potential.

Depending on the type of asset you are trading, you will need to consider the level of liquidity in your market. The greater the depth of the order book, the easier it will be for a retail trader to buy and sell apples. For example, if you are trading BTC/USDT, it is likely that the pair will be illiquid on a newly launched crypto exchange.

If you are investing in a coin that is illiquid, you may end up holding it for too long when the price increases. This is risky. Also, you may end up selling it too early when prices are rising.

Market makers are essential in the financial markets. Their main function is to provide liquidity for the assets they are managing. To make it easier for a trader to enter and exit a trade, a market maker will post ask limit orders.